A Quote by Seth Shostak

The total funding of SETI (the Search for Extraterrestrial Intelligence) in the U.S. is 0.0003 percent of the tax monies spent on health and human services. And it's not even tax money. The SETI Institute's hunt for signals is funded by donations.

Related Quotes

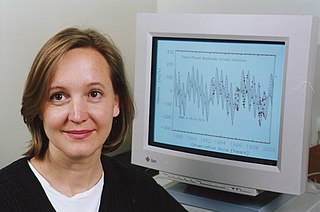

Is E.T. out there? Well, I work at the SETI Institute. That's almost my name. SETI: Search for Extraterrestrial Intelligence. In other words, I look for aliens, and when I tell people that at a cocktail party, they usually look at me with a mildly incredulous look on their face. I try to keep my own face somewhat dispassionate.

I'm at a funny crossroads, personally. I really want to turn my attention away from planet-hunting towards Search for Extra-Terrestrial Intelligence (SETI) program at UC-Berkeley. I'm in this lucky position that my career has been more successful than I could have ever imagined. It's time for me to roll the dice, try something that's a long shot. Younger scientists can't put their eggs in that basket, because if you spend your time on SETI, your chances of success are low. But I have the luxury. There are some experiments we can do to hunt for the great galactic Internet.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

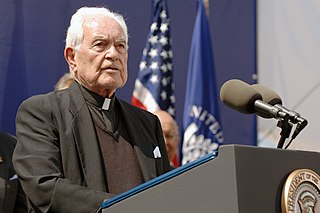

Once He created the Big Bang... He could have envisioned it going in billions of directions as it evolved, including billions of life-forms and billions of kinds of intelligent beings. As a theologian, I would say that the proposed search for extraterrestrial intelligence (SETI) is also a search of knowing and understanding God through his works - especially those works that most reflect Him. Finding others than ourselves would mean knowing Him better.

After 25 quarters of so-called recovery under Obama, it has increased a total of only 14.3 percent. Compare this to earlier periods. After the JFK tax cuts of the early 1960s, the economy grew in total by roughly 40 percent. After the Reagan tax cuts of the 1980s, the economy grew by a total of 34 percent.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

In 1990, about 1 percent of American corporate profits were taken in tax havens like the Cayman Islands. By 2002, it was up to 17 percent, and it'll be up to 20-25 percent very quickly. It's a major problem. Fundamentally, we have a tax system designed for a national, industrial, wage economy, which is what we had in the early 1900s. We now live in a global, asset-based, services world. And we need to have a tax system that follows the economic order or it's going to interfere with economic growth, it's going to reduce people's incomes, and it's going to damage the US.