A Quote by Shaquille O'Neal

I'm like tax. You're going to pay one way or the other.

Related Quotes

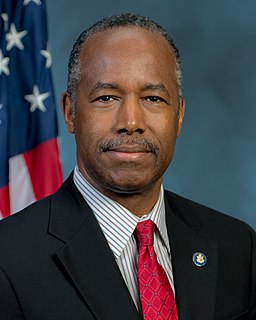

I hope people understand that when you tax corporations that the concrete and the steel and the plastic don't pay. People pay. And so when you tax corporations, either the employees are going to pay or the shareholders are going to pay or the customers are going to pay. And so corporations are people.

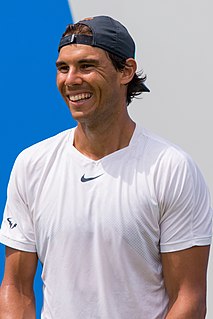

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

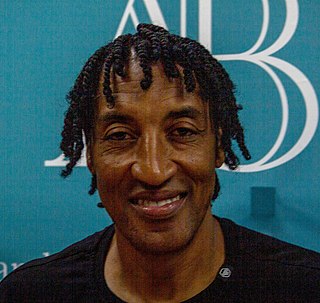

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

My dad's from that generation like a lot of immigrants where he feels like if you come to this country, you pay this thing like the American dream tax: like you're going to endure some racism, and if it doesn't cost you your life, well hey, you lucked out. Pay it; there you go, Uncle Sam. I was born here, so I actually had the audacity of equality.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

One of the tax systems in the US is for wage earners. The government takes money from them out of each paycheck - so it knows how much they make, and those workers can't cheat to any significant degree. But the other tax system is for capital. Those with capital get to tell the government what they want to tell. They may get audited, but if their tax returns are of any size the government doesn't have enough of the smart auditors to figure out what's really going on. And there are the rules that allow you to do things like take in money today and pay taxes on it thirty years from now.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.