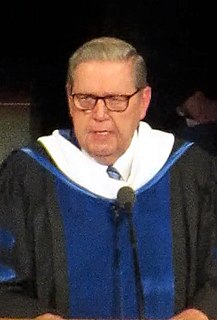

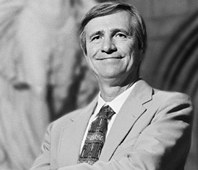

A Quote by Sheena Iyengar

People will make worse financial decisions for them if they're choosing from a lot of options than if they're choosing from a few options. If they have more options they're more likely to avoid stocks and put all their money in money market accounts, which doesn't even grow at the rate of inflation.

Related Quotes

People were actually 6 times more likely to buy a jar of jam if they had encountered 6 than if they encountered 24, so what we learned from this study was that while people were more attracted to having more options, that's what sort of got them in the door or got them to think about jam, when it came to choosing time they were actually less likely to make a choice if they had more to choose from than if they had fewer to choose from.

If bankers can push the loans and make more profits for the bank, they get paid higher bonuses. They often also get stock options. If the bank goes under, they get to keep all of these salaries and options - and the government will bail out the bank. These guys will take their money and run, which is pretty much what they're doing now.

Cash - in savings accounts, short-term CDs or money market deposits - is great for an emergency fund. But to fulfill a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.

The most valuable insight I have made about how people make decisions is that when they become skilled they don't have to make decisions - choices between options. Instead, they can draw on experience and the patterns they have acquired to recognize what to do, ignoring other options. This is the basis of the Recognition-Primed Decision (RPD) model my colleagues and I described thirty years ago.

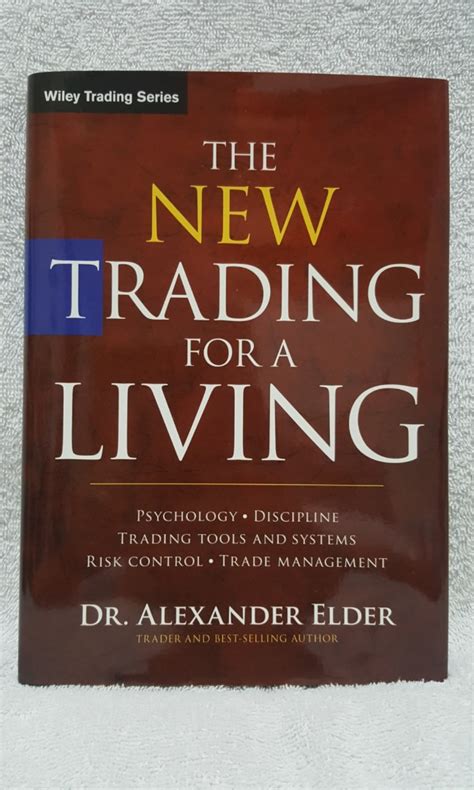

Successful trading depends on the 3M`s - Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger - deciding when to buy and sell. Money refers to how you manage your trading capital.