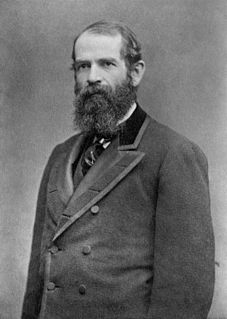

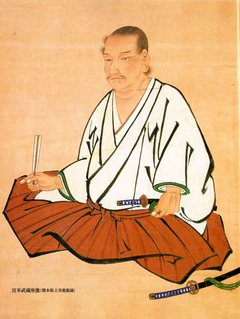

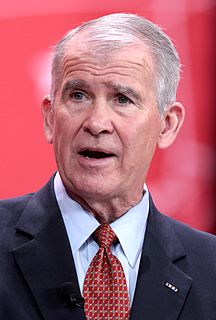

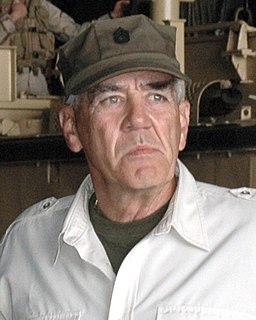

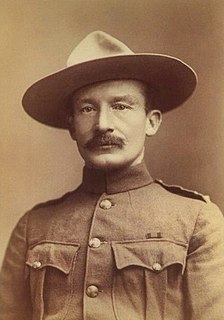

A Quote by Smedley Butler

I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high class muscle-man for Big Business, for Wall Street and for the Bankers. In short, I was a racketeer, a gangster for capitalism.

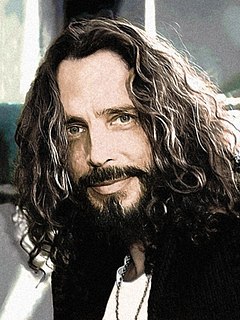

Related Quotes

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

Managing the other fellow's business is a fascinating game. Trade unionists all over the country have pronounced ideas for the reform of Wall Street banks; and Wall Street bankers are not far behind in giving plans for the tremendous improvement of trade union policies. Wholesalers have schemes for improving the retailer; the retailer knows just what is wrong in the conduct of wholesale business-and we might go through a long list.... Yet for some reason the classes that ought to be helped keep on stubbornly clinging to their own method of running their affairs.

There are two kinds of second class men in business. There is the man who puts money first and service second. There is the man who puts service first and money second, who never has any money. The first class man in business is the man who is made up out of rolling the other two kinds into one man and working them together.

We could have saved Wall Street without putting our future in jeopardy. I predicted that there would be all-around consequences - in the long run as well as in the short run. People are now saying we can't afford health care reform because we spent all the money on the banks. So, in effect, we're saying that it's better that we give rich bankers a couple of trillion than giving ordinary Americans access to health care.