A Quote by Sonny Landham

I will cut all state taxes by at least one third.

Related Quotes

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

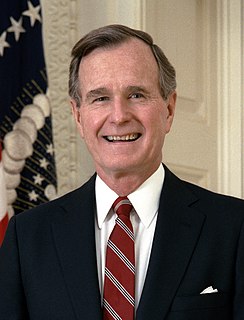

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.