A Quote by Sreenivasan

Our role as producers is mainly limited to borrowing money from friends when we run short of cash.

Related Quotes

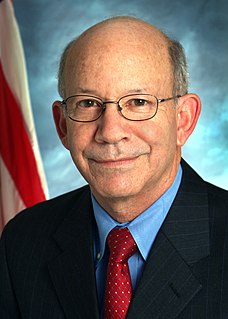

Our business is not based on having information about you. You’re not our product. Our product are these, and this watch, and Macs and so forth. And so we run a very different company. I think everyone has to ask, how do companies make their money? Follow the money. And if they’re making money mainly by collecting gobs of personal data, I think you have a right to be worried.

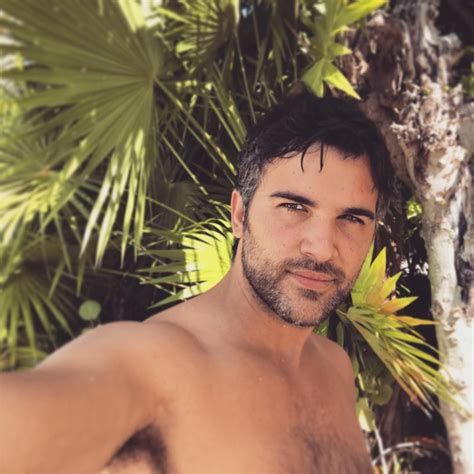

I got the call to play Tony Manero in 'Saturday Night Fever' in Madrid, a role I'd always wanted, as it's such a well-constructed show, and my background is in musical theatre. I'd been travelling back and forth between London and Spain for auditions and had been borrowing money from friends to do it.

While conventional wisdom has traditionally sided against borrowing from retirement savings, sentiment has shifted toward borrowing from one's own assets with the realization that other forms of credit come at a much higher cost and often are not even available to borrowers with limited means and urgent needs.

If your cash is about to run out, you have to cut your cash flow. CEOs have to make those decisions and live with them however painful they may be. You have to act and act now; and act in the best interest of the company as a whole, even if it means that some people in the company who are your best friends have to work somewhere else.