A Quote by Stanley Druckenmiller

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

Related Quotes

The goal of socialism is a fairer allocation of economic resources, which its advocates often claim will also be a less wasteful one. Socialism is about who gets the goods and how. Socialism objects to markets because markets allocate resources in ways socialists believe to be unfair on both counts: both the who and the how.

To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices.

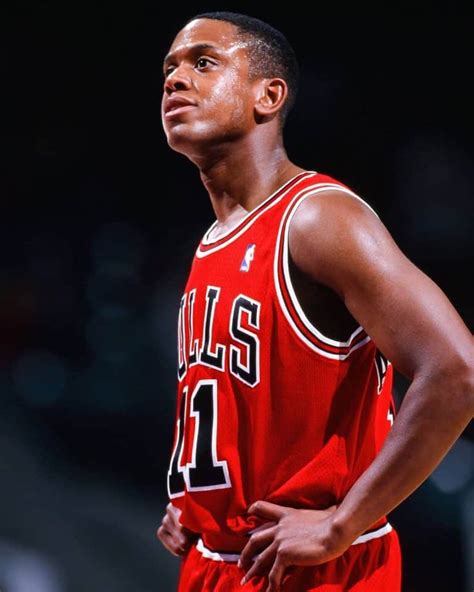

I wanted to learn how the business worked. I wanted to see how people got drafted, how players got traded, how they got picked up in free agency, how the salary cap worked, how do you manage an organization, how do you negotiate contracts. The Bulls gave me an excellent opportunity to answer all the questions that I wanted to ask.

How is it that we have created an economic system that tells us it is cheaper to destroy the earth and exhaust its people than to nurture them both? Is it rational to have an pricing system which discounts the future and sells off the past? How did we create an economic system that confused capital liquidation with income?

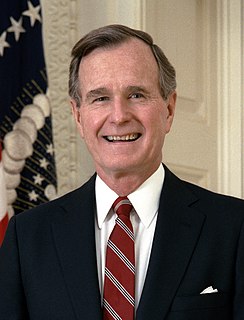

There seems to be something in the zeitgeist, and maybe it's a function of - I'm no analyst, nor am I a psychologist - when you look at things and say, What if I could go back and change things? I think we live in a world right now where people are asking those questions a lot. What if we could go back and change what we did? How would we change the way we handled things in the Middle East, and how would we change things with the banking industry, and how would we change economic and educational issues?

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.