A Quote by Stephanie Ruhle

During my eight years at Deutsche Bank, the bank ticked every box with the elite development programs, coaching, mission statements for the advancement of women - and I was proud to be a part of it.

Related Quotes

What's the best gamble in the world, right now? Its betting that Deutsche Bank stock is going to go down. Short sellers borrowed money from their banks to place bets that Deutsche Bank stock is going to go down. Now, it's wringing its hands and saying, "Oh the speculators are killing us." But it's Deutsche Bank and the other banks that are providing the money to the speculators to bet on credit.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

JPMorgan was already, for the most part. Our businesses at JPMorgan share the same cash-management systems. The commercial bank, the private bank, the retail bank, they all use the branches. The cash-management system moves the money around the world - for global corporations, and for you, the consumer, too.

Imagine you had a bank that each morning credited your account with $1,440 - with one condition: whatever part of the $1,440 you failed to use during the day would be erased from your account, and no balance would be carried over. What would you do? You'd draw out every cent every day and use it to your best advantage. Well, you do have such a bank, and its name is time. Every morning, this bank credits you with 1,440 minutes. And it writes off as forever lost whatever portion you have failed to invest to good purpose.

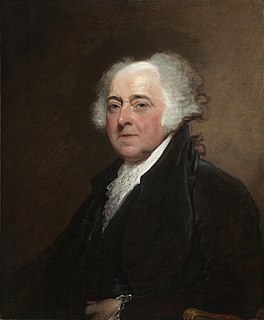

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.