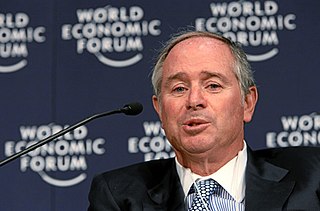

A Quote by Stephen A. Schwarzman

You can't grow unless your banking system is expanding and you are extending credit.

Related Quotes

Italy spills over to everything. Italy is a huge banking system. It has been the major banking system in Eastern Europe. It's worked with Austria's banking system. There's all sorts of interplays there. So it's not the PIIGS one should worry about. Germany hasn't even begun falling yet. And when Germany falls, and it will, that's when the panic begins to set in.

Repeal the entire Banking Act of 1933, and Austrian School economists will cheer, especially if the current system were replaced by a 100%-reserve competitive banking with no central bank. That banking reform would give us a sound money system, meaning no more business cycle, bailouts, or inflation.

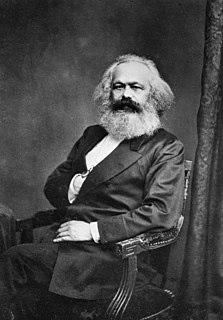

By means of the banking system the distribution of capital as a special business, a social function, is taken out of the hands of the private capitalists and usurers. But at the same time, banking and credit become the most effective means of driving captialist production beyond its own limits and one of the most effective vehicles of crises and swindle.

The smaller man approaching our modern banking system, which controls all issue of credit and therefore pretty well all our industrial and commercial activities, is not what the controllers of that credit call "interesting." He borrows with difficulty and upon high terms, and must pledge security out of all proportion to that which his richer rival has to put down.

Think light! Try to impart a feeling of lightness to the body. Think light. This can be achieved by mentally extending yourself outwards from the centre of the body, i.e., think tall. Think not just of raising your arms but of extending them outwards and when you are holding them still, think again of reaching still further away from your body. Do not think of yourself as a small compressed suffering thing. Think of yourself as graceful and expanding - no matter how unlikely it may seem at the time.

I've got to say our banking system is a safe and a sound one. And since the days when we've had federal deposit insurance in place, we haven't had a depositor who's got less than $100,000 in an account lose a penny. So the American people can be very, very confident about their accounts in our banking system.