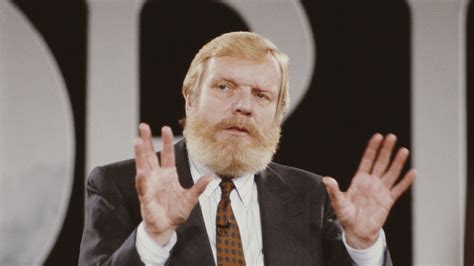

A Quote by Stephen Moore

If I've learned anything as an economic analyst, it is that the stock market and economic winds can shift by the hour.

Related Quotes

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

The correct attitude of the security analyst toward the stock market might well be that of a man toward his wife. He shouldn't pay too much attention to what the lady says, but he can't afford to ignore it entirely. That is pretty much the position that most of us find ourselves vis-à-vis the stock market.

The economic borderlines of our world will not be drawn between countries, but around Economic Domains. Along the twin paths of globalization and decentralization, the economic pieces of the future are being assembled in a new way. Not what is produced by a country or in a country will be of importance, but the production within global Economic Domains, measured as Gross Domain Products. The global market demands a global sharing of talent. The consequence is Mass Customization of Talent and education as the number one economic priority for all countries

The ultimate consequences of the individualist spirit in economic life are those which you yourselves, Venerable Brethren and Beloved Children, see and deplore: Free competition has destroyed itself; economic dictatorship has supplanted the free market; unbridled ambition for power has likewise succeeded greed for gain; all economic life has become tragically hard, inexorable, and cruel.

Housing has always been a key to Great Resets. During the Great Depression and New Deal, the federal government created a new system of housing finance to usher in the era of suburbanization. We need an even more radical shift in housing today. Housing has consumed too much of our economic resources and distorted the economy. It has trapped people who are underwater on their mortgages or can't sell their homes. And in doing so has left the labor market unable to flexibly adjust to new economic realities.

Some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naive trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system.

I have read a great deal of economic theory for over 50 years now, but have found only one economic "law" to which I can find NO exceptions: Where the State prevents a free market, by banning any form of goods or services, consumer demand will create a black market for those goods or services, at vastly higher prices. Can YOU think of a single exception to this law?