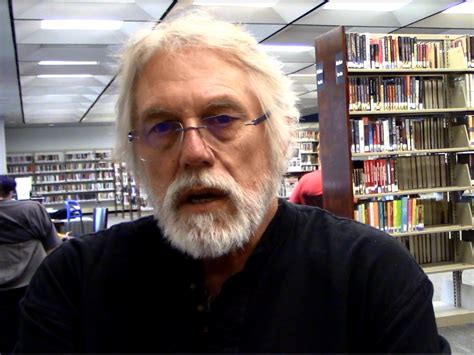

A Quote by Stephen Moore

America should be about owning a piece of the rock, about letting every worker have equity and share in the returns to capital.

Related Quotes

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

The big picture is: the main thing you should be concerned about in the future are incremental returns on capital going forward. As it turns out, past history of a good return on capital is a good proxy for this but obviously not foolproof. I think this is an area where thoughtful analysis can add value to any simple ranking/screening strategy such as the magic formula. When doing in depth analysis of companies, I care very much about long term earnings power, not necessarily so much about the volatility of that earnings power but about my certainty of "normal" earnings power over time.

If we are going to be able to create a new economic vision, companies will need to rethink every aspect of their operations; their bottom lines, ownership structures, demands on financial returns, how they raise capital. For example, an ethical company would say it should only take a fair share of the planet's resources and campaign on this.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

Entrepreneursh ip is not about getting one over on the customer. It’s not about working on your own. It’s not about looking out for number one. It’s not necessarily about making a lot of money. It is absolutely not about letting work take over your life. On the contrary, it’s about turning what excites you in life into capital, so that you can do more of it and move forward with it.

If you're talking to an architect, he can look at a blank piece of paper, and once the initial design is there, the formula kicks in. Each room should have something unique and different about it - much the same way that in a song, every eight bars or so, a new piece of information should be introduced.

There is but one means available to improve the material conditions of mankind: to accelerate the growth of capital accumulated as against the growth in population. The greater the amount of capital invested per head of the worker, the more and better goods can be produced and consumed. This is what capitalism, the much abused profit system, has brought about and brings about daily anew. Yet, most present-day governments and political parties are eager to destroy this system.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.