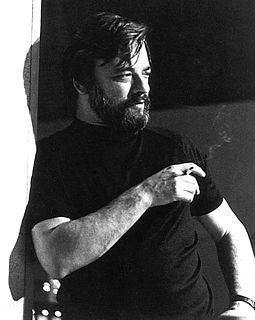

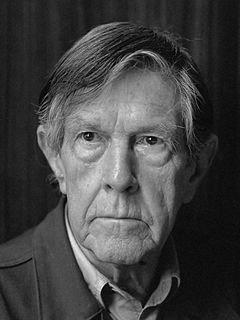

A Quote by Stephen Sondheim

You can't have personal investors anymore because it's too expensive, so you have to have corporate investment or a lot of rich people.

Related Quotes

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.

The Berkshire-style investors tend to be less diversified than other people. The academics have done a terrible disservice to intelligent investors by glorifying the idea of diversification. Because I just think the whole concept is literally almost insane. It emphasizes feeling good about not having your investment results depart very much from average investment results. But why would you get on the bandwagon like that if somebody didn't make you with a whip and a gun?

The rich are the most discriminated-against minority in the world. Openly or covertly, everybody hates the rich because, openly or covertly, everybody envies the rich. Me, I love the rich. Somebody has to love them. Sure, a lot o’ rich people are assholes, but believe me, a lot o’ poor people are assholes, too, and an asshole with money can at least pay for his own drinks.

I think that internet technologies are making everything so transparent. The arms race of deception and spin against the public trying to keep up with it - I think the forces of spin have to lose. In the corporate world people are finding this. Corporate social responsibility has been on the agenda for a very long time - and a lot of people say it's a kind of green-wash or white-wash - but because there's nowhere to hide anymore, people are coming around to the realization that the only way to be seen to be good is to be good. You can't fake it.

Far too many people, especially within evangelicalism, think that the individual is all that matters, and that the corporate dimension is a distraction or diversion. Of course Christianity is deeply personal for every single Christian; nobody gets lost in the kingdom of God. But you can't play that off against the corporate dimension.

I believe that the behavior of too many of our corporations investment bankers and fund managers has jeopardized some of the trust that investors have had. It's not the economic engine that we need to focus on, but the need to make sure that our investors receive their fair share of the returns that that great economic system produces.

Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years they deliver a one-in-a-hundred year flood. They are generally run for rich people in Geneva, Switzerland, by rich people in Greenwich, Connecticut.

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

You look at Donald Trump and Ben Carson and you can see the people supporting them are small donors, the people I always call the ones who make the country work. Certainly not rich corporate CEO types, and these are not people that expect some sort of issue oriented payback. They're donating because of enthusiasm, ideas. The corporate donors are donating 'cause they want policy in return.