A Quote by Steve Bannon

Remember Circuit City? Bear Stearns? Lehman Brothers? Sports Authority? Once, all were billion-dollar companies - then gone in a moment. The fatal problem might be fraud or corruption, but more often, it's simply that management didn't see 'over the other side of the hill.'

Related Quotes

I want to say something, and it may sound harsh, not to you, but to the American people. In a sense, in my view, the business model of Wall Street is fraud. It's fraud. I believe that corruption is rampant, and the fact that major bank after major bank has reached multi billion dollar settlements with the United States government when we have a weak regulator system tells me that not only did we have to bail them out once, if we don't start breaking them up, we're going to have to bail them out again, and I do not want to see that happen.

I can teach many sports, but obviously, tennis is the one. When you do other sports, you see things from different perspectives: different footwork drills, body positions, angles and geometry. All that stuff is helpful, and so when I do other sports, I can see things, because once you know one sport, then the other sport becomes more clear.

We've got the emPHAsis on the wrong sylLAble when it comes to crime in this country. The FBI says burglary and robbery cost U.S. taxpayers $3.8 billion annually. Securities fraud alone costs four times that. And securities fraud is nothing to the cost of oil spills, price-fixing, and dangerous or defective products. Fraud by health-care corporations alone costs us between $100 billion and $400 billion a year. No three-strikes-and-you're-out for these guys. Remember the S&L scandal? $500 billion.

Remember me when I am gone away, Gone far away into the silent land; When you can no more hold me by the hand, Nor I half turn to go yet turning stay. Remember me when no more day by day You tell me of our future that you planned: Only remember me; you understand It will be late to counsel then or pray. Yet if you should forget me for a while And afterward remember, do not grieve: For if the darkness and corruption leave A vestige of the thoughts that once I had, Better by far you should forget and smile Than that you should remember and be sad.

I mean there is no capital requirements to it or anything of the sort. And basically, I said there were possibly financial weapons of mass destruction, and they had them. They destroyed AIG. They certainly contributed to the destruction of Bear Sterns and Lehman. Although Lehman had other problems, too.

The dirty little secret of what used to be known as Wall Street securities firms-Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns-was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty-four hours away from a funding crisis. The key to day-to-day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.

Companies, as they grow to become multi-billion-dollar entities, somehow lose their vision. They insert lots of layers of middle management between the people running the company and the people doing the work. They no longer have an inherent feel or a passion about the products. The creative people, who are the ones who care passionately, have to persuade five layers of management to do what they know is the right thing to do.

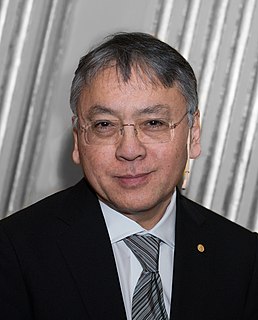

I can see,’ Miss Emily said, ‘that it might look as though you were simply pawns in a game. It can certainly be looked at like that. But think of it. You were lucky pawns. There was a certain climate and now it’s gone. You have to accept that sometimes that’s how things happen in the world. People’s opinions, their feelings, they go one way, then the other. It just so happens you grew up at a certain point in this process.’ ‘It might be just some trend that came and went,’ I said. ‘But for us, it’s our life.