A Quote by Steve Bannon

Not one criminal charge has ever been brought to any bank executive associated with the 2008 crisis. And in fact, it gets worse. No bonuses and none of their equity was taken.

Related Quotes

In existing criminology there are concepts: a criminal man, a criminal profession, a criminal society, a criminal sect, and a criminal tribe, but there is no concept of a criminal state, or a criminal government, or criminal legislation. Consequently what is often regarded as "political" activity is in fact a criminal activity.

'Nobody goes to jail.' This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world's wealth - and nobody went to jail.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

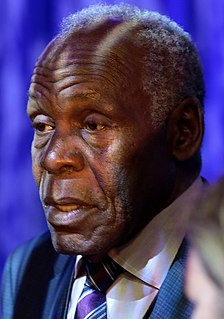

There are things that make me excited about what I'm doing: Trouble the Water [the 2008 documentary Glover executive produced] on New Orleans, or something like Soundtrack for a Revolution, about the power of the music of the civil rights movement [which he executive produced in 2009]. Or Bamako, about the African debt crisis, a platform to discuss the experience of people who actually live it. All of these are important ways we can use film as a forum inviting people into a dialogue.