A Quote by Steve Case

There are lots of cycles to markets - boom and bust - and also in perceptions of people. The conventional wisdom of Steve Case as genius or fool was highly cyclical. The truth was always in the middle.

Related Quotes

Boom and bust cycles are very difficult for businesses because you're hiring a bunch because you're planning for the future. And if the future is going to be very big, you need to hire people, or suddenly you go to boom to bust, then all of a sudden, you're kind of battening down the hatches and trying to sail, you know, through the storm, it's a different thing. So part of it is making good decisions about, well, how long is a boom cycle going to be, you know, don't plan on it going forever.

We create these boom-bust cycles by manipulating the money supply and the interest rates and directing it where it went in. And that is what happened with housing: pushed into housing combination of easy money plus all the regulations, and we created this boom-bust cycle, and corruption, because corruption goes with it, because you don't have the same discipline. So we've got to stop all that.

In certain circumstances, financial markets can affect the so-called fundamentals which they are supposed to reflect. When that happens, markets enter into a state of dynamic disequilibrium and behave quite differently from what would be considered normal by the theory of efficient markets. Such boom/bust sequences do not arise very often, but when they do, they can be very disruptive, exactly because they affect the fundamentals of the economy.

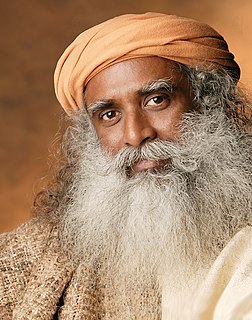

When we say we have patterns, there is a cyclical movement to everything. Our psychological and emotional processes also have become cyclical largely because of a very strong attachment and involvement with physical process, and physical process has to be cyclical; only then we exist. Without out cyclical movement there'll be no physical existence.

There are lots of people who believe there may be at least some genetic component to procrastination, and even if there isn't, it seems to be the case that procrastination habits are often set relatively early in life (that's certainly the case with me). But I also think that there's lots of evidence that external tools can help quite a bit in getting people to stop procrastinating.