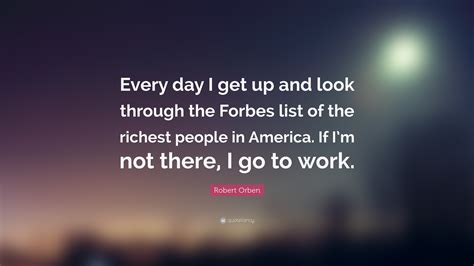

A Quote by Steve Eisman

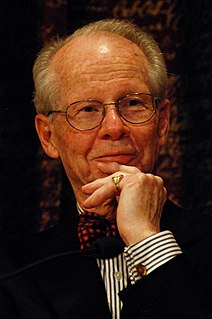

Alan Greenspan is the worst Chairman of the Fed in history.

Related Quotes

During the Greenspan-Bernanke era, the Fed has embraced the view that stability in the economy and stability in prices are mutually consistent. As long as inflation remains at or below its target level, the Fed's modus operandi is to panic at the sight of real or perceived economic trouble and provide emergency relief.