A Quote by Steve Forbes

The tax code is a monstrosity and there's only one thing to do with it. Scrap it, kill it, drive a stake through its heart, bury it and hope it never rises again to terrorize the American people.

Related Quotes

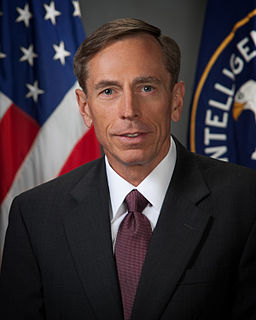

We can put a stake through the heart of Islamic State as an army. We can put a stake through the heart of its leaders. You can take away its territory. But you can't put a stake through the heart of the ideas, of the ideology, that sadly, tragically, still has some attraction for some small numbers in the Islamic faith.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.