A Quote by Steve Jurvetson

If you thought financial crises came and went, just count on them - another economic collapse, it's almost going to be like not news any more. But for startups this is great, because it's a perpetual driver of disruption.

Related Quotes

The future will be less predictable, forecast rises will shrink, company lifetimes will shrink, new entrants will proliferate and it’s going to just get more unpredictable. If you thought financial crises came and went, just count on them – another economic collapse, it’s almost going to be like not news any more. But for startups this is great, because it’s a perpetual driver of disruption.

In the immediate postwar era, financial crises in advanced countries were rare events, and before 1970 did not happen at all. Since then they have occurred more often, and 2008 was the most damaging of them all to date. If we have moved back to a regime of regular financial crises - like the one we had from the 1870s to the 1930s - then our economic future will be very different from our recent past.

I was petrified because all my friends would be going to Washington, DC, to protest. I was sixteen, and I was like, "I don't think I'll be going with you guys," just because I was scared. Then you saw the news, and cops - not students in schools with guns - cops are killing sixteen year old protesters on the news. To me that was more horrifying, to have the authority figures actually killing people on the evening news, than to have another student firing a gun.

One of the problems with industrialism is that it's based on the premise of more and more. It has to keep expanding to keep going. More and more television sets. More and more cars. More and more steel, and more and more pollution. We don't question whether we need any more or what we'll do with them. We just have to keep on making more and more if we are to keep going. Sooner or later it's going to collapse. ... Look what we have done already with the principle of more and more when it comes to nuclear weapons.

Look at any financial institution, at any bank. They're all photocopies of each other. There's no diversity of institutions and even less diversity of currency. Therefore, just as you say its very logical that an ecosystem like this will collapse, it's very predictable a monetary system like this will collapse, too. And it hasn't finished collapsing, by the way.

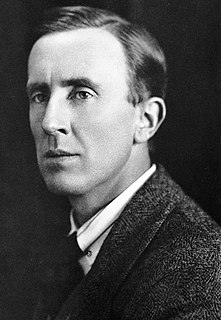

Gandalf! I thought you were dead! But then I thought I was dead myself. Is everything sad going to come untrue? What's happened to the world?" A great Shadow has departed," said Gandalf, and then he laughed and the sound was like music, or like water in a parched land; and as he listened the thought came to Sam that he had not heard laughter, the pure sound of merriment, for days upon days without count.

Besides, we weren't made to battle villains, because there weren't any. No nation, creed, or race was any better or worse than another; all were flawed, all were equally doomed to suffering, mostly because they couldn't see that they were all alike. Mortals might have been contemptible, true, but not evil entirely. They did enjoy killing one another and frequently came up with ingenious excuses for doing so on a grand scale-religions, economic theories, ethnic pride-but we couldn't condemn them for it, as it was in their mortal natures and they were too stupid to know any better.

The presently existing global financial and monetary system will disintegrate during the near term. The collapse might occur this spring, or summer, or next autumn; it could come next year; it will almost certainly occur during President William Clinton's first term in office; it will occur soon. That collapse into disintegration is inevitable, because it could not be stopped now by anything but the politically improbable decision by leading governments to put the relevant financial and monetary institutions into bankruptcy reorganization.

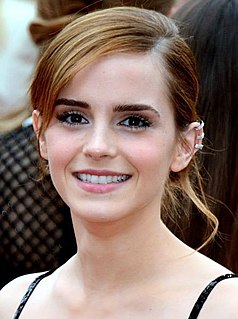

It's almost like the better I do, the more my feeling of inadequacy actually increases, because I'm just going, 'Any moment, someone's going to find out I'm a total fraud, and that I don't deserve any of what I've achieved. I can't possibly live up to what everyone thinks I am and what everyone's expectations of me are.'

I like Twitter more than Facebook. Twitter is a great way to deliver and get news. In news writing less is more and 140 characters is great. If you can't grab that headline in 140 characters than it's not a story. Viewers tweet all the time and they tell what stories they like and don't like. It's great to interact with them and get that instant feedback. It's great for the viewer and the journalist.