A Quote by Steve Jurvetson

There is no correlation between a weak IPO market and an impact on early-stage VCs.

Related Quotes

The last 10 to 20 years you’d think that it has been all about VCs making money, because that’s all we hear about. But really it is all about VCs failing and failing to return capital and being f**king idiots. VCs are stupid. They are absolutely stupid. Does anyone want to challenge that statement? Does anyone think that VCs are not stupid?

You don't actually find a strong correlation between- top-line GDP growth and making money in the market. It- it seems like you should. The fastest-growing countries should give you the highest return. They simply don't. But, there's only four of us- that- that believe that story. Everyone else in the world believes that if you grow fast like China, you'll outperform in the stock market.

Often, there is no correlation between the success of a company's operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.

Beauty has never been an important topic in the writings of the major psychologists. In fact, for Jung, aesthetics is a weak, early stage of development. He follows the Germanic view that ethics is more important than aesthetics, and he draws a stark contrast between the two. Freud may have written about literature a bit, but an aesthetic sensitivity is not part of his psychology.

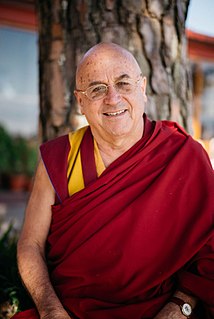

[Some of the people I'd met] were wonderful people as human beings, and some people were more difficult. I could not see a correlation between their particular genius in playing chess and music and mathematics, etc. ... with human qualities. Some were really good, wonderful people, and some were difficult characters, but there was no clear correlation. But when I met some spiritual masters, [I thought that] there had to be a correlation, and it turned out to be true.

However, you have to recognize that regulations will never be completely successful and they will always be full of holes. You must constantly be ready to fill new holes. Actually regulation should be kept to a minimum, but there has to be some cooperation between market participants and authorities - as was the case in the early postwar years. The Bank of England was a very successful regulator by cooperating with market participants. This cooperative spirit was broken by the market fundamentalists.