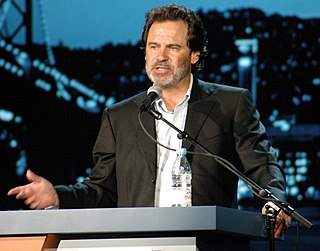

A Quote by Steve Rubel

Let's face it, we're skunk drunk and it's because of money. It's almost like we all need to enter Betty Ford Clinic 2.0 together. This time, it's not stock market money but private equity, M&A, VCs and to some degree the reckless abandonment of logic by some advertisers who are perpetuating what is sure to end badly when the economy turns. Hubris is back my friends.

Related Quotes

When I say the economy is shrinking, it's the economy of the 99%, the people who have to work for a living and depend on earning money for what they can spend. The 1% makes its money basically by lending out their money to the 99%, on charging interest and speculating. So the stock market's doubled, the bond market's gone way up, and the 1% are earning more money than ever before, but the 99% are not. They're having to pay the 1%.

If you have money draining out of the public equity markets, that inevitably affects the private equity market. They cannot exist going in different directions because somehow that will rent the fabric of the universe. It's just not permitted that that happens. Obviously there can be anomalies for brief periods of time but it just can't happen forever.

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

Look, rich people already have a lot of money. There's literally trillions of dollars in cash held by corporations, their stock valuations at an all-time high. They do not need a tax cut to do anything. They can invest now, if they wanted to. They don't want to, because they can make more money just by mergers and stock buybacks and stuff like that. So, this is really just sort of a travesty.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

The three auto companies in the United States, they're all scrambling to come up with a plan, some way to reinvent themselves. Well this week Ford did its part. Ford unveiled a new hybrid, the Ford Fusion, which will get almost 40 miles to the gallon. Isn't that amazing? Yeah, and when asked how much it would cost, a spokesman for Ford said, '$25 billion.' They just want that money; they don't care. That's without mud flaps.