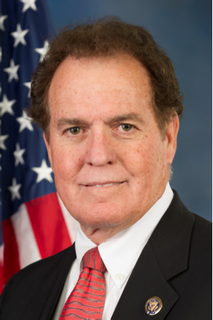

A Quote by Steve Scalise

Related Quotes

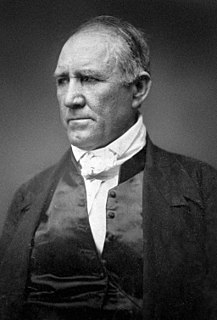

I have ever been opposed to banks, - opposed to internal improvements by the general government, - opposed to distribution of public lands among the states, - opposed to taking the power from the hands of the people, - opposed to special monopolies, - opposed to a protective tariff, - opposed to a latitudinal construction of the constitution, - opposed to slavery agitation and disunion. This is my democracy. Point to a single act of my public career not in keeping with these principles.

The insurance companies make about $15 billion a year. They have doubled their profit margin under Obamacare. And so now we're going to take a lot of this and call it a stabilization fund, but really it's a bailout of insurance companies. And I just think that's wrong. I just can't see why ordinary, average taxpayers would be giving money to very, very wealthy corporations. An analogous situation would be this: We all complain that new cars cost too much. Why don't we have a new car stabilization fund and give $130 billion to car companies?

Today's consumers are eager to become loyal fans of companies that respect purposeful capitalism. They are not opposed to companies making a profit; indeed, they may even be investors in these companies - but at the core, they want more empathic, enlightened corporations that seek a balance between profit and purpose.