A Quote by Steven G. Calabresi

Income tax filing and payment day should be moved from April 15th to November 1st so it can be close to election day. People ought to have their tax bills fresh in mind as they go to vote.

Related Quotes

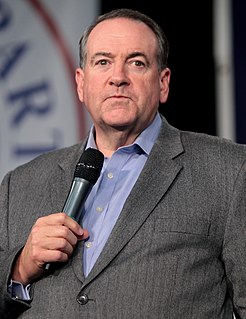

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

A fraudulent vote is a stolen vote. It steals a vote from the thin air and nullifies the legal and legitimate vote of a tax-paying citizen, whose rights to a fair election shouldn’t be tampered with. Winning an election is important, but winning it honestly is imperative in a Constitutional Republic.