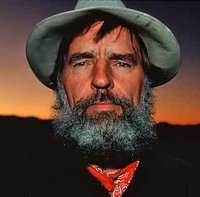

A Quote by Steven Zelin

Tax deductible, That's what you are: Tax deductible. Just like my car, like a gift to local charity, you give my 1040 clarity

Related Quotes

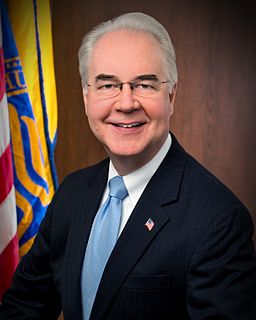

We've got people that are paying premiums of $1,000 a month out there, and then they've got a deductible of $1,000. If you're making $40,000, $50,000, $60,000 out there and you've got an Obamacare plan, by and large you've got an insurance card, but you don't have any care because you can't afford the deductible.