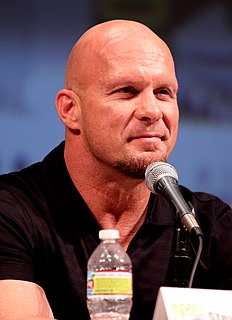

A Quote by Stone Cold Steve Austin

Save your money, pay your taxes, it doesn't last forever.

Related Quotes

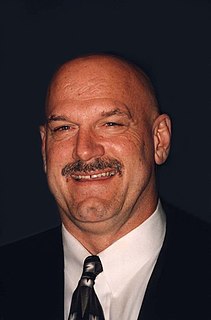

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

We owe more money than any Nation in the World, and we are LOWERING TAXES. When is the time to pay off a debt if it is not when you are doing well? You let a Politician return home from Washington and announce, 'Boys we lowered your taxes. We had to borrow the money to do it, but we did it.' Say, they would elect him for life.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

Remember that all tax revenue is the result of holding a gun to somebody's head. Not paying taxes is against the law. If you don't pay your taxes, you'll be fined. If you don't pay the fine, you'll be jailed. If you try to escape from jail, you'll be shot. ... Therefore, every time the government spends money on anything, you have to ask yourself, 'Would I kill my kindly, gray-haired mother for this?'

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.