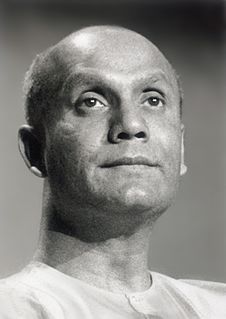

A Quote by Sucheta Dalal

Look around you and you see plenty of prosperous businessmen splurging money like there was no tomorrow but paying no taxes.

Related Quotes

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.