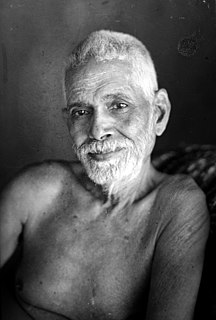

A Quote by Sucheta Dalal

Nobody expects the tax collector to be a friend, but one does expect the government to apply its mind to making payments and refunds fair and user friendly especially for those who are actually paying tax.

Related Quotes

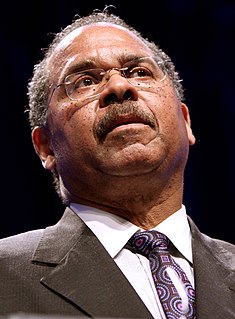

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

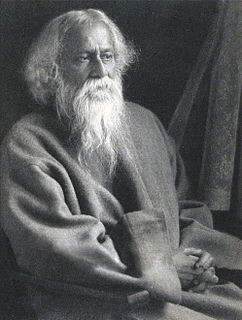

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.