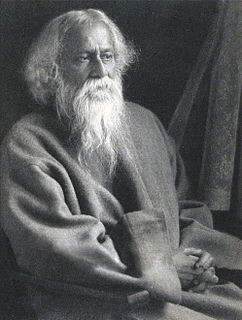

A Quote by Sucheta Dalal

There is nothing as nervous as a highly overbought and slightly crazy stock market dominated by greedy small investors and day traders all out to squeeze a huge profit out of the present bull run.

Related Quotes

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently. Yet market timing appears to be increasingly embraced by mutual fund investors and the professional managers of fund portfolios alike.

I report the assault on nature evidenced in coal mining that tears the tops off mountains and dumps them into rivers, sacrificing the health and lives of those in the river valleys to short-term profit, and I see a link between that process and the stock-market frenzy which scorns long-term investments-genuine savings-in favor of quick turnovers and speculative bubbles whose inevitable bursting leaves insiders with stuffed pockets and millions of small stockholders, pensioners, and employees out of work, out of luck, and out of hope.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

One of the ironies of the stock market is the emphasis on activity. Brokers, using terms such as 'marketability' and 'liquidity,' sing the praises of companies with high share turnover... but investors should understand that what is good for the croupier is not good for the customer. A hyperactive stock market is the pick pocket of enterprise.

Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks.