A Quote by Sung Won Sohn

I think the concern over rising interest rates is ahead of itself because I think inflationary fears themselves might be premature.

Quote Topics

Related Quotes

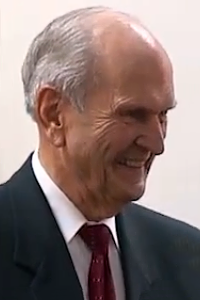

We live in a time of turmoil. Earthquakes and tsunamis wreak devastation, governments collapse, economic stresses are severe, the family is under attack,

and divorce rates are rising. We have great cause for concern. But we do not need to let our fears displace our faith. We can combat those fears by strengthening our faith.

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.

If you let interest rates be freed, be set by the free market, they would rise dramatically. There would be a lot of broken furniture on Wall Street. It needs to be broken. The back of the speculative bubble would be broken and we could slowly heal the financial system. That's what I think we need to do but it's never going to happen because there's trillions of asset values dependent on the Fed continuing to suppress, repress interest rates and shovel $85 billion a month of liquidity into the market.

According to the Bank of England the economy is growing too fast so interest rates must rise to counter the supposed inflationary threat. In lay terms, I interpret this to mean that people are working much harder, causing economic growth, and they're in danger of spending their money, which is what the recession-hit shops want them to do. But the Bank and the City seem to think this is wrong, and that if people work harder they should be punished by having their mortgages increased.

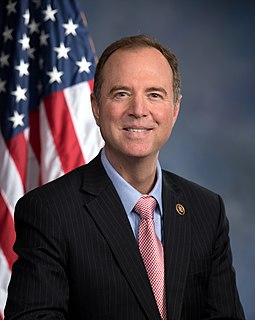

It was an echo of Director Comey's testimony that Trump showed no curiosity, no interest, no concern over the Russia hack. The only element of it that concerned him was how it might impact him personally. That says, I think, a lot about where the president is coming from, but it was quite jarring given this was an attack on our democracy by a foreign power.