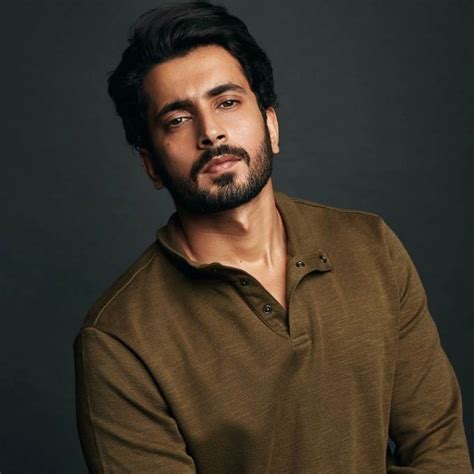

A Quote by Sunny Singh

Supporting customers through multiple channels is no longer an option for financial services organizations; it's a necessity.

Related Quotes

By any measure, CapitalSource outperformed both our direct competitors and the financial services industry in general, particularly in the context of the near collapse of the financial services industry where 19 of the 20 largest financial institutions in the country either failed or were bailed out by the government.

Today, financial capital is no longer the key asset. It is human capital. Success is no longer about economic competence as the main leverage. It is about emotional intelligence. It is no longer about controls. It is about collaboration. It is no longer about hierarchies. It is about leading through networks. It is no longer about aligning people through structures and spreadsheets. It is about aligning them through meaning and purpose. It is no longer about developing followers. It is about developing leaders.

The Harper Government is committed to ensuring that seniors have the skills they need to make solid financial choices. Seniors today face an increasingly complex financial marketplace, and it will take the combined efforts of public and private sector organizations to help seniors navigate the many financial choices they face. The start of Financial Literacy Month is an excellent opportunity to thank the Canadian Bankers Association and encourage other private sector organizations to take an active role in providing financial literacy support to Canada's seniors.

The role of business is to provide products and services that make people's live better - while using fewer resources - and to act lawfully and with integrity. Businesses that do this through voluntary exchanges not only benefit through increased profits, they bring better and more competitively priced goods and services to market. This creates a win-win situation customers and companies alike.