A Quote by Susan Davis

Congress also did something new, which is, they delayed for two years two new taxes - one on medical devices and one on high-end health insurance plans. Those taxes are supposed to help pay for President Obama's health care law, but they're really unpopular.

Related Quotes

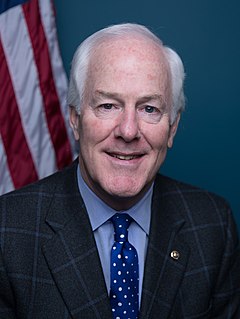

As a physician and a U.S. senator, I have warned since the very beginning about many troubling aspects of Mr. Obama's unprecedented health-insurance mandate. Not only does he believe he can order you to buy insurance, the president also incorrectly equates health insurance coverage with medical care.

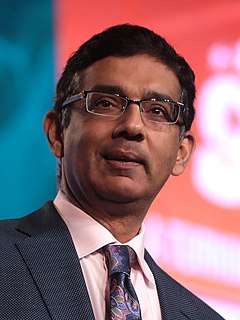

Obama's health care plan will be written by a committee whose head, John Conyers, says he doesn't understand it. It'll be passed by Congress that has not read it, signed by a president who smokes, funded by a Treasury chief who didn't pay his taxes, overseen by a Surgeon General who is obese, and financed by a country that's nearly broke. What could possibly go wrong?

I thought you liberals cared about people, but here you're perfectly content to get them addicted to tobacco and make them pay taxes through the nose and continue to pay taxes through the nose and raise their taxes. And then you try to make 'em think you care about 'em by running PSAs telling them how they shouldn't smoke and how they should quit. You're exactly right. If they really cared, they would ban the product, but they can't, because the revenue from tobacco taxes - I'm not kidding you - funds children's health care programs, and a number of other things as well.

President Obama is also standing up for women in North Carolina and across our country. He has helped women fight for equal pay for equal work; he has fought to guarantee that women have access to quality, affordable health care, including making sure that insurance plans cover birth control with no out-of-pocket cost.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.