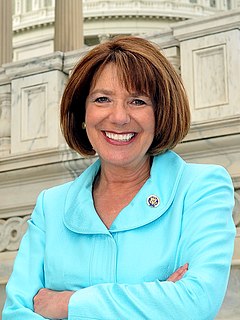

A Quote by Susan Davis

Another agency - the IRS - did not do as well under Republicans who control Congress. The IRS is largely flatlined in their spending, but they did get about 300 million more funding. But I can only be used to help people pay their taxes and answer questions. It can't be used for any other purpose.

Related Quotes

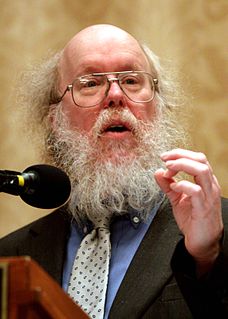

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

Every year I write a tax advice column and I used to always make fun of that. One year, one of my favorite IRS commissioners, I think his name was Roscoe somebody, wrote that one of the most often-asked questions by taxpayers was, "How can I contribute more?" Well, I tell ya, ol' Roscoe's really been doing situps under parked cars again. I've heard a lot of people ask a lot of questions about taxes, but I never heard anybody say, "How can I, the ordinary person, send more money for no reason?"

Much has already been learned about the arrogance of the IRS from the House investigations of the agency's targeting of conservatives. The revelations emerged despite strenuous efforts by Democrats in Washington and by the IRS itself to block inquiries and deny the existence of political targeting - targeting that the former head of the IRS Exempt Organizations Unit, Lois Lerner, eventually acknowledged and apologized for in May 2013.

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

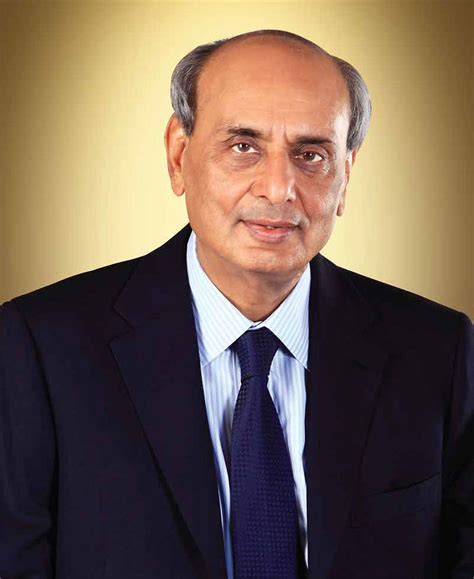

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.