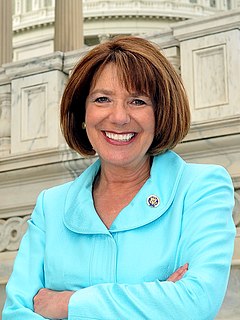

A Quote by Susan Davis

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

Related Quotes

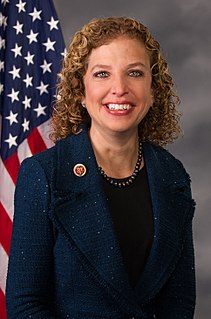

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

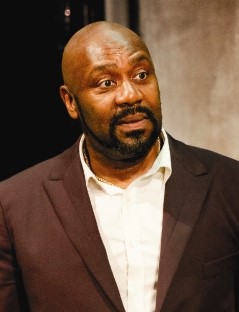

When you consider that a steelworker who's making $40,000 a year has virtually the same tax burden as someone who's making $400,000 a year, you see that there are inequities. This administration has used the tax code to accelerate wealth to the top. Most of the tax breaks have gone to people in the top bracket.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

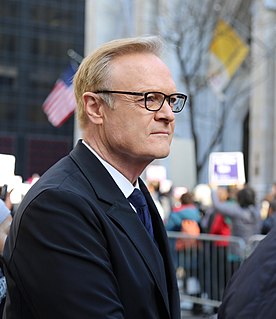

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

If we choose to keep those tax breaks for millionaires and billionaires, if we choose to keep a tax break for corporate jet owners, if we choose to keep tax breaks for oil and gas companies that are making hundreds of billions of dollars, then that means we've got to cut some kids off from getting a college scholarship.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.