A Quote by Susan George

The World Bank is now the biggest culprit in the debt crisis.

Quote Topics

Related Quotes

The moment a large investor doesn't believe a government will pay back its debt when it says it will, a crisis of confidence could develop. Investors have scant patience for the years of good governance - politically fraught fiscal restructuring, austerity and debt rescheduling - it takes to defuse a sovereign-debt crisis.

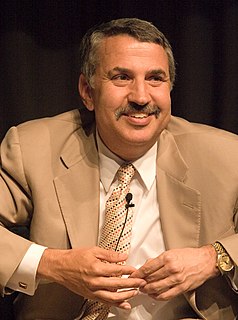

If you followed this economic crisis and you do not think that the world is getting flatter, you are not paying attention. We saw the entire global economy at one time acting totally in sync. The real truth is the world is even flatter than I thought. Our mortgage crisis is killing Deutsche Bank. You still don't think the world is flat?

Bad karma is the spiritual debt one has accumulated for one's mistakes from all previous lives and this life. It includes killing, harming, taking advantage, cheating, stealing, and more. On Mother Earth, when you buy a house, you take out a mortgage from a bank. This mortgage is your debt to the bank. You pay every month for fifteen, twenty, or thirty years to clear your financial debt. In the spiritual realm, if you have bad karma, you may have to pay for many lifetimes to clear your spiritual debt.

This debt crisis coming to our country. The wall and tidal wave of debt that is befalling our nation. Medicare and Social Security go bankrupt within ten years, we have a debt that is looming so high that in the last year of President Obama's budget just the interest payments on our debt is $916 billion dollars.

If we keep kicking the can down the road, if we follow the president's lead or if we pass the Senate budget, then we will have a debt crisis. Then everybody gets hurt. You know who gets hurt first and the worst in a debt crisis? The poor, the elderly. That's what we're trying to prevent from happening.