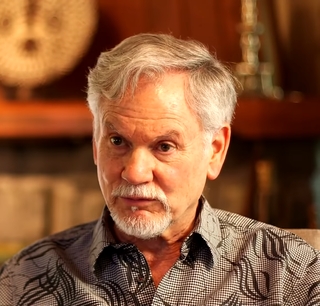

A Quote by Suze Orman

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.

Related Quotes

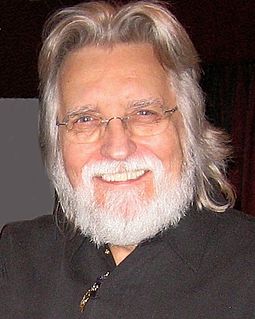

When a man is forced into early retirement, he is often being 'given up for a younger man.' Being forced into early retirement can be to a man what being 'given up for a younger woman' is for a woman... Why do many men get more upset by retirement than women do from the empty nest when their children leave home? When females retire from children, they can try a career; when a man retires from a career, his children are gone.

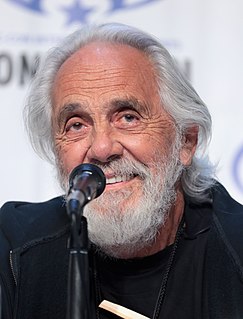

We think that life is about get the girl, get the guy, get the car, get the job, get the house, get the kids, get the better job, get the better car, get the better house, get the promotion, get the office in the corner, get the kids on their way, get the grandkids, get the retirement watch, get the cruise tickets, get the illness, and get the heck out. That's it. That's a good life. But life has nothing to do with any of that. That is not our purpose in living. That is not the Agenda of the Soul.

There are two things that you need to save for. First, you need an emergency cushion of no fewer than six months of living expenses. This needs to be cash in a liquid account where you can get at it in - yes - an emergency if you need it. In other words, money markets, not CDs. You also need to save for your future: that means retirement.

If we stop believing in a future, if we stop doing things for something else but start doing them for now, some fundamental things change. Retirement becomes less about how much money you can squirrel away now and much more a matter of participating and contributing to your own community now so that they want to take care of you. … We’re going to move into a world where your retirement will be more secure if you’ve made lots of friends with young people rather than collected lots of dollars.

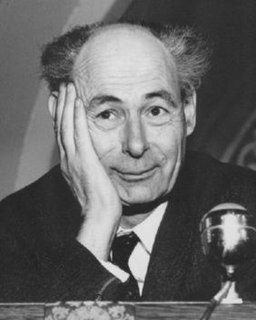

My financial adviser Ric Edelman...thinks the time to start educating people about money is when they are children. He's set up a retirement plan called the RIC-E-Trust that can provide retirement security. A $5,000 one-time tax-deferred investment at birth, with an average interest rate of ten percent compounded, means that a child would have $2.4 million when he or she is 65 years old. Who needs Social Security with that kind of nest egg?