A Quote by Suze Orman

If you're saving for the long run, it's actually a good thing when the market is down because the more shares you have, the more you can potentially make when markets rise. And over time - decades, not months - the markets rise more than they fall.

Related Quotes

Markets are a social construction, they're made from institutions. We in a democratic society create markets, we constitute markets, we bring them into existence, and we shouldn't turn markets over to a narrow group of people who regulate them and run them in their interests, rather they should be run democratically for the common good.

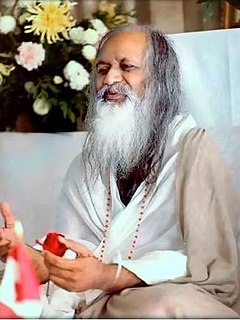

The world has witnessed the rise and fall of monarchy, the rise and fall of dictatorship, the rise and fall of feudalism, the rise and fall of communism, and the rise of democracy; and now we are witnessing the fall of democracy... the theme of the evolution of life continues, sweeping away with it all that does not blossom into perfection.

History speaks pretty clearly that the markets do better with Democrats. Republicans' ideas of what constitutes fiscal responsibility simply are not good for the stock market. Democrats have many tendencies, but one of them is to look after the workers, and actually that tends to be good for demand and good for markets.

In the past six months, our federal government has devised a dozen strategies to save America's financial markets. Each plan has been more costly, more risky, and less aligned with the principles of our country's free market economy than the last. I am disappointed to say that this latest plan puts all the rest of them to shame.