A Quote by Suze Orman

Make it a priority to have at least eight months of living costs set aside in a federally insured bank or credit union account.

Related Quotes

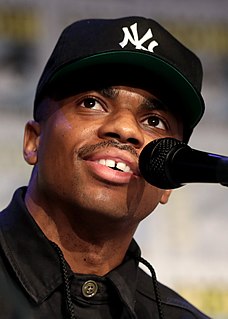

There was a time in L.A. when I drove to 7-Eleven to go grocery shopping, and I locked my keys in my car, which wasn't insured. My wallet was in there, and I couldn't call AAA, because I only had $7 in my bank account. It was one of those moments where I was like, 'O.K., I literally have nothing right now.

There was a time in L.A. when I drove to 7-Eleven to go grocery shopping, and I locked my keys in my car, which wasn't insured. My wallet was in there, and I couldn't call AAA, because I only had $7 in my bank account. It was one of those moments where I was like, 'O.K., I literally have nothing right now.'

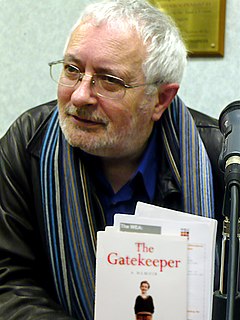

The most common mistake students of literature make is to go straight for what the poem or novel says, setting aside the way that it says it. To read like this is to set aside the ‘literariness’ of the work – the fact that it is a poem or play or novel, rather than an account of the incidence of soil erosion in Nebraska.

If you do not have at least an eight-month emergency fund, and you think there's a probability you could loose your job - and it's not just losing your job; you could be in a car accident, get sick - continue to pay the minimum on your credit card every month. Everything beyond that needs to go to establish an emergency fund. And if you have an emergency fund saved, then fund your retirement account before paying down credit card debt.