A Quote by Suze Orman

I have never been a fan of bond funds. Unlike a direct investment in an individual bond that you can hold to maturity and be assured you will get your principal back (assuming no default), a fund has no finite maturity date and most funds are actively traded.

Related Quotes

Even fans of actively managed funds often concede that most other investors would be better off in index funds. But buoyed by abundant self-confidence, these folks aren't about to give up on actively managed funds themselves. A tad delusional? I think so. Picking the best-performing funds is 'like trying to predict the dice before you roll them down the craps table,' says an investment adviser in Boca Raton, FL. 'I can't do it. The public can't do it.'

Invest in low-turnover, passively managed index funds... and stay away from profit-driven investment management organizations... The mutual fund industry is a colossal failure... resulting from its systematic exploitation of individual investors... as funds extract enormous sums from investors in exchange for providing a shocking disservice... Excessive management fees take their toll, and manager profits dominate fiduciary responsibility.

The culture of the mutual fund industry, when I came into it in 1951, was pretty much a culture of fiduciary duty and investment, with funds run by investment professionals. The firm I worked with, Wellington Management Co., they had one fund. That was very typical in the industry... investment professionals focused on long-term investing.

The fund scandals shined the spotlight on the fact that mutual fund managers were putting their interests ahead of the fund shareholders who trusted them, which had much more substantial consequences in the form of excessive fees and the promotion - as the market moved into the stratosphere - of technology funds and new economy funds which were soon to collapse.

The thing to do with mutual funds is to buy a couple of decent ones, set up an investment plan and then never, ever think about them again, except maybe once a quarter or so when you take a peek at your statements to make sure that you have not accidentally been buying the Fidelity Peace-in-the-Middle-East fund.

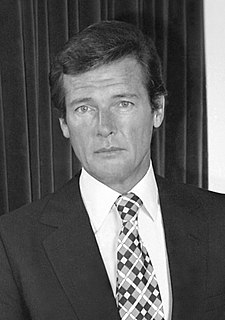

The new Bond film, will be a big, big hit, because every Bond film is an event. Fathers take their sons to it; probably grandfathers. It's been a long time, and I think that the success of Bond is because the audiences have never been cheated by the producers. They always spend every penny, put it on the screen, and then the things that people expect to see in a Bond film - big action scenes, glamorous ladies - it's pure escapism.

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.