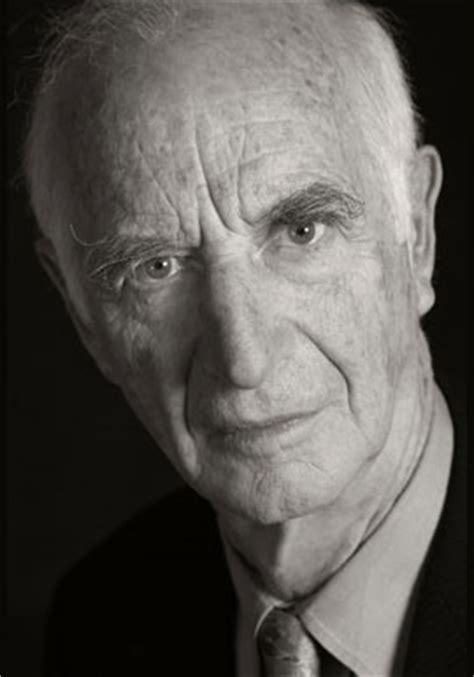

A Quote by Suze Orman

You should keep a copy of your tax return indefinitely, but you need to save supporting documents for only three years.

Related Quotes

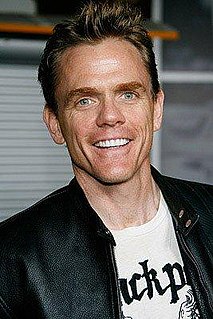

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

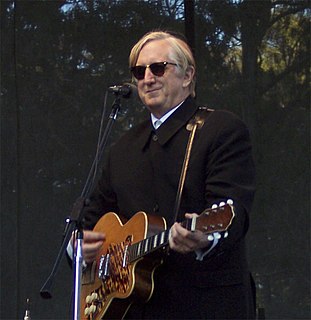

In America, one of the great liberal documents of the world is the Declaration of Independence. One of the great conservative documents of the world is the Constitution of the United States. We need both documents to build a country. One to get it started - liberal. And the other to help maintain the structure over the years - conservative.

I can't stop some idiot from crashing into a building or blowing up a bus, I can only be your dad and give you a few pure truths. Number one, duct tape will save your life. Number two, Tupac is alive, but I need you to keep that on the DL because of Suge. And number three, don't be afraid of anything - except the television news because they're lying to you every night.

The time to buy stocks is consistently over time. You should never buy your investments with the idea, 'I have to get a certain return.' You should look at the best return possible and learn to live with that. But you should not try to make your investments earn what you feel you need. It doesn't work that way. The stock doesn't know you own it.

You need a clear, legitimate excuse for why you're behind [the bankruptcy], such as a layoff, divorce, or medical emergency. Be prepared to back up the circumstances with supporting documents. Anything you have to substantiate your story - including proof that you have, for instance, been actively looking for a new job - will help.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.