A Quote by Suze Orman

Remember: If the IRS suspects you haven't reported income, it can challenge returns from the past six years. So if you are self-employed or have multiple income sources, hold on to six years of files to be absolutely safe.

Related Quotes

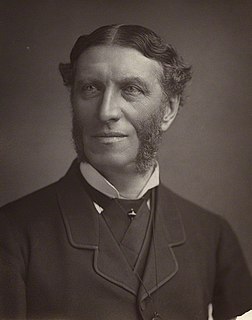

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

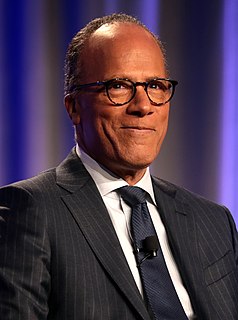

There are two economic realities in America today. There's been a record six straight years of job growth, and new census numbers show incomes have increased at a record rate after years of stagnation. However, income inequality remains significant, and nearly half of Americans are living paycheck to paycheck.

There are two economic realities in America in 2016. There's been a record six straight years of job growth, and new census numbers show incomes have increased at a record rate after years of stagnation. However, income inequality remains significant, and nearly half of Americans are living paycheck to paycheck.

There are 11 states in the United States that in the last 50 years instituted an income tax. So I looked at each of those 11 states over the last 50 years, and I took their current economic metrics and their metrics for the five years before they put in the progressive income tax... Every single state that introduced a progressive income tax has declined as an overall share of the U.S. economy.

You will learn more about Donald Trump by going down to the federal elections, where I filed a 104-page essentially financial statement of sorts, the forms that they have. It shows income - in fact, the income - I just looked today - the income is filed at $694 million for this past year, $694 million. If you would have told me I was going to make that 15 or 20 years ago, I would have been very surprised.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.