A Quote by T. Coleman Andrews

I don't like the income tax. Every time we talk about these taxes we get around to the idea of 'from each according to his capacity and to each according to his needs'. That's socialism. It's written into the Communist Manifesto. Maybe we ought to see that every person who gets a tax return receives a copy of the Communist Manifesto with it so he can see what's happening to him.

Related Quotes

The income tax is bad because it was conceived in class hatred, is an instrument of vengeance and plays right into the hands of the communists. It employs the vicious communist principle of taking from each according to his accumulation of the fruits of his labor and giving to others according to their needs, regardless of whether those needs are the result of indolence, or lack of pride, self-respect, personal dignity or other attributes of men.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.

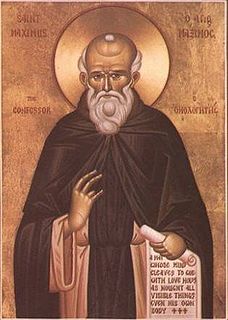

He who asks to receive his daily bread does not automatically receive it in its fullness as it is in itself: he receives it according to his own capacity as recipient. The Bread of Life (cf. Jn. 6:35) gives Himself in His love to all who ask, but not in the same way to all; for He gives Himself more fully to those who have performed great acts of righteousness, and in smaller measure to those who have not achieved so much. He gives Himself to each person according to that person's spiritual ability to receive Him.

We need each other to do things that we can't do for ourselves. If we are intimately connected with each other, we just give things to each other; if we don't know each other we find another way to handle it. If you think about it, each according to his or her abilities and each according to his or her needs is sort of the same thing as supply and demand.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.

If the citizens of the United States are to turn away from the Communist Manifesto and preserve the purpose of the Declaration of Independence, the U.S. Constitution, and our Bill of Rights, we must first thoroughly reexamine and learn about each of them, and uphold America's founding documents by testing every political action in light of them.

Within a capitalist corporation, someone says, "Lend me a wrench," and someone asks, "Yeah, what do I get?" You assume that the idea of each according to his or her abilities, each according to his or her needs - in solving a problem - is actually the only thing that works. And in situations of disaster, there are often communistic notions of improvisation, where you basically exchange hierarchies and all of a sudden all those things that are luxuries that you can't afford, you have them in an emergency.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.