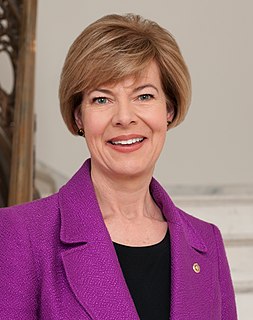

A Quote by Tammy Baldwin

Americans are not saving enough for retirement.

Quote Topics

Related Quotes

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

The proven method for saving the lives of innocent Americans is not disarming them. The proven method for saving the lives of innocent Americans is to arrest, prosecute, convict and jail criminal offenders, especially armed career criminals illegally using guns. This is the way to reduce gun violence.

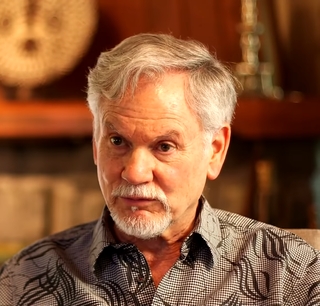

One of the strongest lessons I learned in doing six months of work on retirement topic was how absolutely crucial the Social Security system is for the great mass of Americans. The research of professionals and our own reporting convinced me that many millions of people are not capable of effectively managing the finances for their own retirement.