A Quote by Tate Reeves

Eliminating the franchise tax is really about economic growth on Main Street.

Quote Topics

Related Quotes

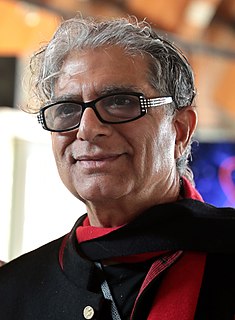

The impact of QE on generating more lending by Wall Street to Main Street and in generating more employment and increasing overall investment in the economy is quite modest. QE probably limited the initial collapse of the economy in 2008, and likely had a very small positive impact on economic growth, but its broader impact on jobs and growth in the economy seems not very big.

Donald Trump wants to dramatically reduce America's corporate tax rate (to 15%) and thereby unleash economic growth. Hillary Clinton hasn't said a word about lowering corporate tax rates. Being a Fedzillacrat, you don't need to be an economic soothsayer to know that she supports taxing the producers and further strangling America's anemic economy.

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

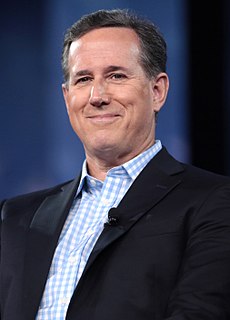

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.