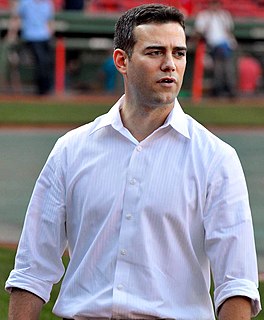

A Quote by Theo Epstein

If the seller has a player that they think is going to have a lot of value, they're aware of it, protect that value. You have to go get it. That's the way the trade market works.

Related Quotes

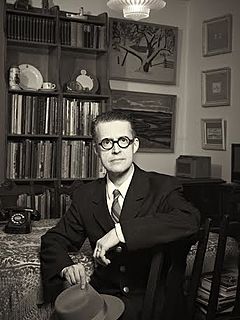

I used to think that good short-sellers could be trained like long-focused value investors because it should be the same skill set; you’re tearing into the numbers, you’re valuing the businesses, you’re assigning a consolidated value, and hopefully you’re seeing something the market doesn’t see.But now I’ve learned that there’s a big difference between a long-focused value investor and a good short-seller. That difference is psychological and I think it falls into the realm of behavioral finance.

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.

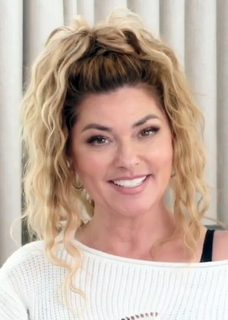

I think that all people that get to a certain level of their celebrity are brands. I accept that. I don't value it in any personal way. I value it as an element of my work. I'm more pragmatic in that sense. I do get very rattled if I don't get enough normalcy in my life. I like solitude. I can't even write music if I'm not isolated.

See the investment world as an ocean and buy where you get the most value for your money. Right now the value is in non-callable bonds. Most bonds are callable so when they start going up in price, the debtor calls them away from you. But the non-callable bonds, especially those non-callable for 25-30 years, can go way up in price if interest rates go way down.