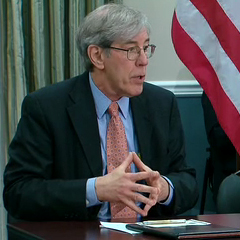

A Quote by Thom Tillis

Any time you do tax reform, you really need to have a transition period.

Quote Topics

Related Quotes

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

We need to review the process for the election of Speaker. We've got to reform Question Time, which is really a waste of time. There are so many things that we need to do to reform our Parliament and I think it's bigger than that. It's all about the sort of leadership that people are getting at the moment. They're fed up with this sorta day-to-day bickering, not putting the national interest ahead of these narrow partisan interests.