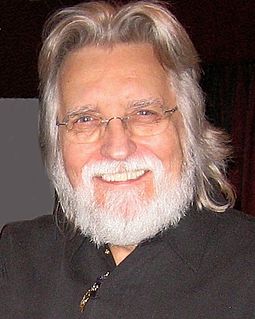

A Quote by Thomas Frank

Our current way of regulating the financial system is dysfunctional. Oversight is dispersed among numerous confusing bodies that at times have seemed to be racing each other to the bottom. Setting up One Big Regulator would end that problem.

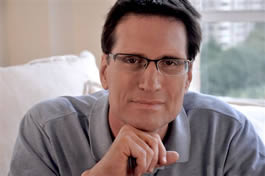

Related Quotes

The global financial crisis is a great opportunity to showcase and propagate both causal and moral institutional analysis. The crisis shows major flaws in the way the US financial system is regulated and, more importantly, in our political system, which is essentially a bazaar of legalized bribery where financial institutions can buy themselves the governmental regulations they want, along with the regulators who routinely receive lucrative jobs in the industry whose oversight had formerly been their responsibility, the so-called revolving-door practice.

The problem facing humanity today is not a political problem; it's not a financial problem; it's not a military problem. It's obviously a spiritual problem. That is, it has to do with what we believe to be true about who we are, where we are, why we are where we are, and what are we doing on the Earth. What is the purpose of life itself? What we need right now are leaders or models, people who will stand up and not only help to write a cultural story, but help to model it in the way that they interact with each other.

A single agency responsible for systemic risk would be accountable in a way that no regulator was in the run-up to the 2008 crisis. With access to all necessary information to monitor the markets, this regulator would have a better chance of identifying and limiting the impact of future speculative bubbles.

If we generally like the way things are now, we must also ask whether our current situation is really so different from the open ages of radio, film, or the telephone. Might it not also have seemed in those times that the orgy of limitless entrepreneurism would never end? The point is that we are near the high end of a pendulum arc that, so far, has aways begun to swing in the opposite direction -toward greater integration and centralization- with a force that can seem inexorable.

Sears had layers and layers of people it didn't need. It was very bureaucratic. It was slow to think. And there was an established way of thinking. If you poked your head up with a new thought, the system kind of turned against you. It was everything in the way of a dysfunctional big bureaucracy that you would expect.

There are regulators at the SEC and elsewhere who are really excited about the potential of the blockchain. They understand you can build a robust financial system - it would solve all your black swan problems. All kinds of mischief and games that are played in the current system become impossible in this system.

Early on, in discussions of financial oversight, people would say, 'Well, this is a very complicated problem, therefore it requires a complicated solution.' And at that step, I would say, 'Well, wait a minute. Just because it's a complicated problem doesn't mean the best course of action immediately is one that's complicated.'

Parenting classes should be mandatory, whether you are adopting or not, and would include an evaluation of your current physical, mental and financial state as well as how ready you are to take on the rigors of parenthood. Our children are our most precious natural resource, and there is absolutely no other way to parent but to put them first.