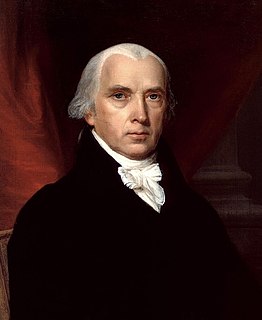

A Quote by Thomas Jefferson

Specie [gold and silver coin] is the most perfect medium because it will preserve its own level; because, having intrinsic and universal value, it can never die in our hands, and it is the surest resource of reliance in time of war.

Related Quotes

The available supply of gold and silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money intrinsic value that may come into use.

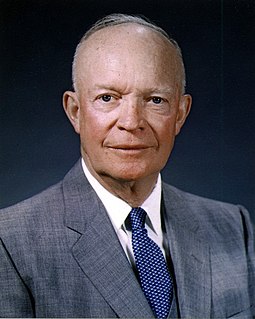

If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content.

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.

I have heard your orators speak on many questions. One among them the so-called vital question of money which is above all things the most coveted commodity but I, as a Jainist, in the name of my countrymen and of my country, would offer you as the medium of the most perfect exchange between us, henceforth and forever, the indestructible, the unchangeable, the universal currency of good will and peace, and this, my brothers and sisters, is a currency that is not interchangeable with silver and gold, it is a currency of the heart, of the good life, of the highest estate on the earth.

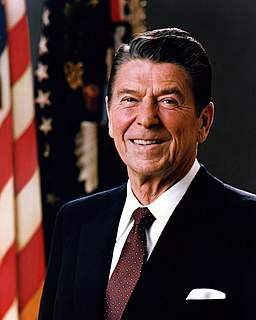

When people become frightened, they look for things of real value. They will go to monetary metals, gold and silver, and they will buy other things, such as buying property. But no matter what we have, whether we have our gold coins or we have our property, if we have an authoritarian government, that is our greatest threat. So, I would like to think that there is no perfect protection, other than shrinking the size and scope and power of government, so that we can be left alone and take care of ourselves.

Back in 1960, the paper dollar and the silver dollar both were the same value. They circulated next to each other. Today? The paper dollar has lost 95% of its value, while the silver dollar is worth $34, and produced a 2-3 times rise in real value. Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.

It takes time--loose, unstructured dreamtime-- to experience nature in a meaningful way. Unless parents are vigilant, such time becomes a scarce resource, not because we intend it to shrink, but because time is consumed by multiple, invisible forces; because our culture currently places so little value on natural play.

Violence is the gold standard, the reserve that guarantees order. In actuality, it is better than a gold standard, because violence has universal value. Violence transcends the quirks of philosophy, religion, technology, and culture. () It's time to quit worrying and learn to love the battle axe. History teaches us that if we don't, someone else will.

Prior to 1968, the gullible gentiles could take a one dollar Federal Reserve note into any bank in America and redeem it for a dollar which was by law a coin containing 412 1/2 grains of 90 per cent silver. Up until 1933, one could have redeemed the same note for a coin of 25 4/5ths grains of 90 per cent gold. All we do is give the goy more non-redeemable notes, or else copper slugs. But we never give them their gold and silver. Only more paper.