A Quote by Thomas Piketty

My premise is not to tax to destroy the wealth of the wealthy; it's to increase the wealth of the bottom and the middle class.

Related Quotes

Between 2013 and 2015, the wealthiest 14 people saw their wealth increase by $157 billion. This is their wealth increase, got it? Not what they are worth. Increase. That $157 billion is more wealth than is owned by the bottom 40 percent of the American people. One family, the Walton family, owns more wealth than the bottom 40 percent.

What's happening is there's transfer of wealth from the poor and the middle class to the wealthy. This comes about because of the monetary system that we have. When you inflate a currency or destroy a currency, the middle class gets wiped out, so the people who get to use the money first, which is created by the Federal Reserve System, benefit, so the money gravitates to the banks and to Wall Street. That's why you have more billionaires than ever before.

They talk about class warfare -- the fact of the matter is there has been class warfare for the last thirty years. It's a handful of billionaires taking on the entire middle-class and working-class of this country. And the result is you now have in America the most unequal distribution of wealth and income of any major country on Earth and the worst inequality in America since 1928. How could anybody defend the top 400 richest people in this country owning more wealth than the bottom half of America, 150 million people?

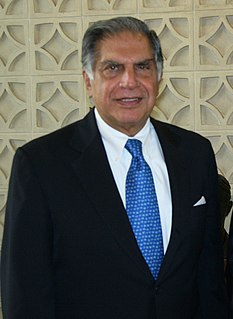

The - the early Rockefellers made their wealth from being in certain businesses and - and remained personally very wealthy. Tatas were different in the sense the future generations were not so wealthy. They - they were involved in the business, but most of the family wealth is put into trust, and the family did not, in fact, enjoy enormous wealth.

The early Rockefellers made their wealth from being in certain businesses and remained personally very wealthy. Tata's were different in the sense the future generations were not so wealthy. They were involved in the business but most of the family wealth was put into trust and most of the family did not in fact did not enjoy enormous wealth.