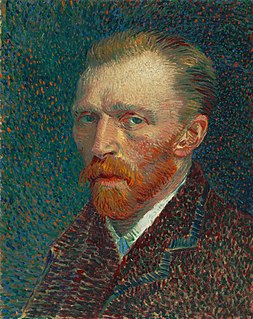

A Quote by Thomas Pogge

The bottom half of humanity is living in severe poverty; not all of them are malnourished or severely deprived now, but they are extremely vulnerable to even small upsets in their income or in the prices they face of basic necessities, and when something like this happens, they can be thrown off kilter in terms of a disease of a family member or a change in food prices; anything like that can throw them into destitution.

Related Quotes

In the richest country in the history of the world, this Obama economy has crushed the middle class. Family income has fallen by $4,000, but health insurance premiums are higher, food prices are higher, utility bills are higher, and gasoline prices have doubled. Today more Americans wake up in poverty than ever before.

Stock prices are likely to be among the prices that are relatively vulnerable to purely social movements because there is no accepted theory by which to understand the worth of stocks....investors have no model or at best a very incomplete model of behavior of prices, dividend, or earnings, of speculative assets.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

People want to buy cheap and sell dear; this by itself makes them countertrend. But the notion of cheapness or dearness must be anchored to something. People tend to view the prices they’re used to as normal and prices removed from these levels as aberrant. This perpective leads people to trade counter to an emerging trend on the assumption that prices will eventually return to “normal”. Therein lies the path to disaster.

We must act now and wake up to our moral obligations. The poor and vulnerable are members of God's family and are the most severely affected by droughts, high temperatures, the flooding of coastal cities, and more severe and unpredictable weather events resulting from climate change. We, who should have been responsible stewards preserving our vulnerable, fragile planet home, have been wantonly wasteful through our reckless consumerism, devouring irreplaceable natural resources.