A Quote by Thomas Sowell

The income tax has spawned an intrusive bureaucracy, creating so much complexity and red tape that millions of ordinary citizens have to go get some accountant to fill out the forms for them - and then sign under penalty of perjury that it was done right. If you knew how to do it right, you wouldn't have to go to somebody else to have it done, would you?

Related Quotes

More than half of all people filing income tax forms use someone else to prepare the forms for them. Then they have to sign under penalty of perjury that these forms are correct. But if they were competent to determine that, why would they have to pay someone else to do their taxes for them in the first place?

If you say actors have a social responsibility to do things, you are right, in a way. It's a wishful decision. But if it's done out of force, I don't think it will accomplish anything. Everybody starts counting how much work they have done and see if they have done their due for the week. That is not social service. You need to go way beyond that.

I personally have always voted for the death penalty because I believe that people who go out prepared to take the lives of other people forfeit their own right to live. I believe that that death penalty should be used only very rarely, but I believe that no-one should go out certain that no matter how cruel, how vicious, how hideous their murder, they themselves will not suffer the death penalty.

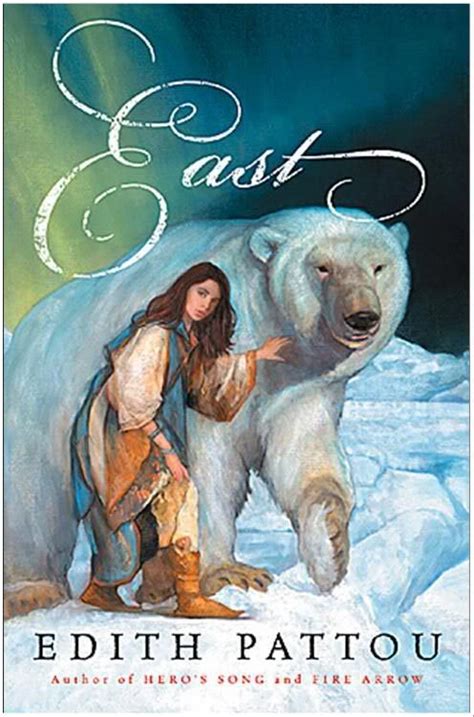

East of the sun and west of the moon.' As unfathomable as the words were, I realized I must figure them out, reason it through. For I would go to this impossible land that lay east of the sun and west of the moon. From the moment the sleigh had vanished from sight and I could no longer hear the silver bells I knew that I would go after the stranger that had been the white bear to make right the terrible wrong I had done him.... All that mattered was to make things right. And I would do whatever it took, journey to wherever I must, to reach that goal.

Swoopers write a story quickly, higgledy-piggledy, crinkum-crankum, any which way. Then they go over it again painstakingly, fixing everything that is just plain awful or doesn’t work. Bashers go one sentence at a time, getting it exactly right before they go on to the next one. When they’re done they’re done.

When you think of policies that are going to address inequality of wealth, you have to be very thoughtful about what economists call "incidence of taxes." If most of the savings is being done by capitalists, and you tax the return on capital, then they will have less to invest. That would mean, over the long run, that the rate of interest would go up. That would therefore undo some of the intent to lower the income of capitalists.

We want stuff done right. As long as it's my team, I'll voice my opinion. Yep, it's my team. You media guys might give it to him, like you've given him everything else his whole lifetime, but this is the Diesel's ship. And if we're not right, I'm going to go out there and try to get it right... Just ask Karl and Garywhy they wanted to come here. It was because of one person, not two. One.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

The men who go out the scientists who go out, they have so much fun on the way that when they get there well it's done. So they're looking for another thing. You see the objective may remain the same - the search - but you must get lost on the way, get stupid to my mind, this is what you do in theatre; a team of people go out to look for something, they find, maybe, something else.

In a typical 401k plan, when you first become eligible you get a big pile of forms and you're told, fill out these forms if you want to join. Tell us how much amount you've saved and how you want to invest the money. In, under automatic enrollment you get that same pile of forms but the top page says, if you don't fill out these forms, we're going to enroll you anyway and we're going to enroll you at this saving rate and in these investments.

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.