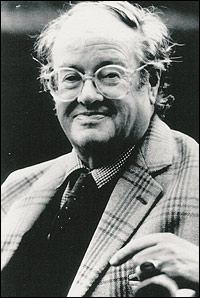

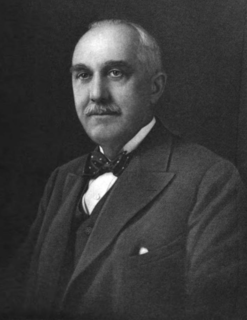

A Quote by Thomas W. Lamont

There has been a little distress selling on the stock exchange.

Related Quotes

In college I started studying the stock market. I went down to the stock exchange, watched all the activity from the visitors' gallery, people running around, calling numbers, shouting, and all the paper flying and the bells ringing, and of course that was exciting, and it seemed to lend itself to my analytical skills.